Why Join FPA?

Welcome to your professional home!

Let us show you how your FPA membership

makes a difference.

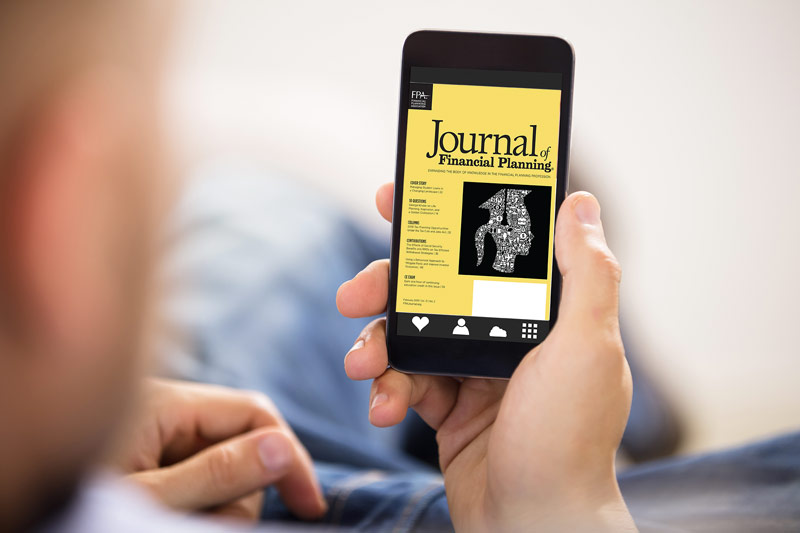

In the financial planning profession, while there are many diverse factors that contribute to success, there’s simply no substitute for relevant, useful, quality content. FPA members receive a monthly print subscription and unlimited digital access to the Journal of Financial Planning, the gold standard when it comes to credible thought leadership for the profession. Members also have access to the FPA Next Generation Planner, a monthly digital publication created by and for financial planners in the NexGen community.

Frequency and Relevance

The Journal is published on the first business day of each month, and is available in print, online and via the Journal of Financial Planning app. Many FPA members set aside time each month to read the new issue cover to cover.

The Best Continuing Education Available

Each issue of the Journal of Financial Planning offers free CE credits, allowing members to fulfill reporting requirements through the consumption of exclusive content that drives genuine personal and professional growth.

Transferable and Expansive

The theme of the Journal feeds into other mediums each month, such as the Journal in the Round webinar, allowing members to dig deeper into the topics that matter in the financial planning profession.

SUPPORTING THE NEXT GENERATION

The FPA Next Generation Planner is a monthly app publication that provides practical, valuable content to help new financial planners develop personally and professionally as they work their way toward their most important career goals (available for members via the Apple App and Google Play Stores).

Make Your Own Contribution

FPA members are encouraged to read the writing guidelines and suggested writing topics on the websites for the Journal and the FPA Next Generation Planner, and submit an article or a Letter to the Editor on a topic you are passionate about.

To join FPA and take advantage of the Journal of Financial Planning and the FPA Next Generation Planner, contact the FPA Member Services team at [email protected], give us a call at (800) 322-4237 or use the button below.

We believe, of course, that the Financial Planning Association® (FPA) offers a value to our members that they can’t get anywhere else. In listening to our members, however, the benefits we provide are rarely the primary reason financial planners join FPA. Instead, they join because they want to be part of something greater than themselves and to make an impact, and FPA gives them a platform to do just that.

FPA and our members are the voice of the financial planning profession, and we make it easy to get involved:

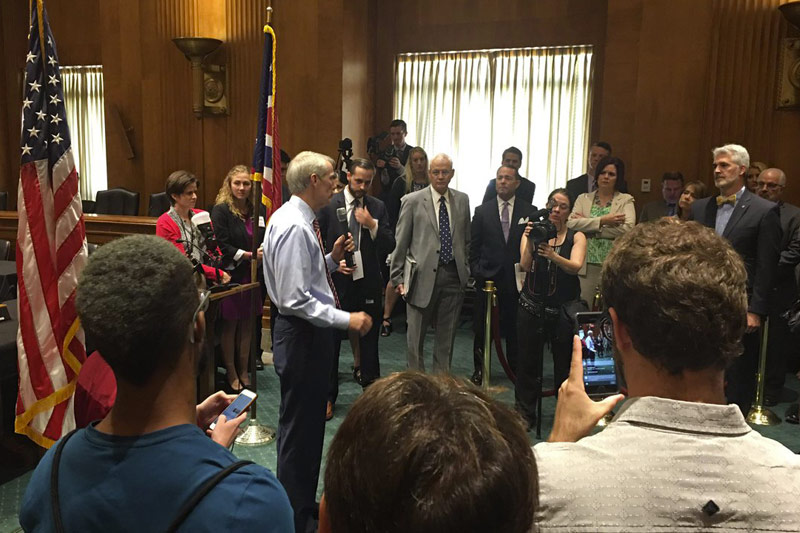

Lend Your Voice to Legislative Efforts

From Advocacy Days at the national and state level, to the ability to contribute to and distribute letters and statements to policymakers, FPA offers a wealth of opportunities for members to engage in protecting their practices and guiding the profession.

Make an Impact with Pro Bono Planning

FPA offers opportunities for members to get involved in pro bono financial planning efforts at the national level, as well as in their own backyards via local chapter programs.

Become a Go-To Expert for Media

Through the FPA MediaSource program, make your voice heard through access to local and national media.

Share Your Expertise

FPA members are encouraged to read the writing guidelines and suggested writing topics on the Journal website, and submit an article or a Letter to the Editor on a topic you are passionate about.

As an FPA member, your contributions are the single most important component in fostering the healthy, sustainable growth of the financial planning profession. Individually, we may struggle to drive true change forward, but together, there’s nothing we cannot achieve.

If you would like to learn more, contact us via email at

[email protected] or give us a call at (800) 322-4237, Option 2.

Like most professions, financial planners are consistently placed into different boxes, categories and frameworks by the various entities attempting to understand how to speak or sell to this audience. In practice, however, it’s as difficult and problematic as it is to brand consumers as “Millennials” and “Baby Boomers.” Financial planners as a group are simply too diverse in age, experience, career path, wants and needs to separate into categories - and that’s a good thing!

We believe that true financial planners, regardless of demographic categorization, are more similar than they are different. The differentiator is a commitment to true financial planning; planners that help their clients define fulfillment for themselves play an integral role in guiding them to reach their potential and do so as a service, not a transaction. It does planners new to the profession little good to be compartmentalized or excluded from events and discussions with experienced planners, and the reverse is also true.

FPA is home to both experienced and new financial planners, and nearly every planner in between, because our community focuses not on age, tenure, region or history, but on a shared commitment to making each other better, and building the profession together. The changing nature of the world we live in ensures there’s always more knowledge to gather, and the transference of wisdom between young planners and those with more experience will be a critical component to creating a profession we can be proud of.

We hope you will become a member of FPA to take advantage of the myriad opportunities to connect with the most skilled, passionate and diverse community of planners available - to get a sense of how our planners engage (and how you can begin to get involved), check out the following:

FPA Activate Facebook Group

A vibrant social media forum designed to be the go-to community for financial planners who want to fast track their careers and develop their financial planning skills.

"You're A Financial Planner, Now What?" Podcast

Each week, FPA offers a brand-new edition of the "You’re A Financial Planner, Now What? podcast, and featuring influential guests offering inspirational stories, valuable insights and expert commentary on a wide range of different financial planning topics. While the podcast aims to help new financial planners gain a foothold in the profession, the content and topics covered are often relevant to planners at every career stage.

Twitter (@fpassociation and @FPAPubs)

With more than 36,000 followers between our two primary Twitter handles, Twitter offers an excellent way to keep up with FPA news at both the national and the local (chapter) level. The @fpassociation handle is our primary handle, while @FPAPubs is focused primarily on Journal of Financial Planning content.

If you would like to learn more, contact us via email at

[email protected] or give us a call at (800) 322-4237, Option 2.

We all seek to belong to something, and community is the container in which our sense of belonging can be fulfilled. Community matters at the Financial Planning Association® (FPA) not only because of the value our affiliated financial planners gather when it comes to personal and professional growth, but in the power of idea sharing, passion and inspiration, which elevates the profession.

Our members engage and connect with their peers, FPA staff and the many thought leaders and influencers affiliated with the association in a variety of ways. There’s no one right way to do it, so the most important component is what makes you feel the most comfortable:

Online Communities

Our primary peer-to- peer online community, FPA Connect, is professionally moderated, compliance-friendly and the best place to find the questions, answers and topics that are most important to financial planners. The FPA Activate Facebook Group, a vibrant social media forum designed to be the go-to community for financial planners who want to fast track their careers and develop their financial planning skills, is open to the public.

Engage with Planners in Your Area

The ability to engage virtually with practitioners, members and financial planning thought leaders from across the globe is one of the great perks of FPA membership, and the most successful members unite the virtual experience with the intrinsic value of in-person connections at the local level. Most FPA members are affiliated with a local FPA Chapter, offering in-person and virtual events and meet-ups specific to your area. This added benefit to membership is included in your annual dues.

Many Ways to Get Involved

There are myriad other ways to see and hear what your peers are saying and to join in the discussion. The forums above are simply a great place to start, and illustrate the wide spectrum of engaging financial planning-focused discussion and conversation that serves as one of the most valuable benefits of FPA membership.

If you would like to learn more, contact us via email at

[email protected] or give us a call at (800) 322-4237, Option 2.

To grow a healthy financial planning practice today, planners must have access to research, referrals and the latest tools for practice management. FPA offers a rich platform of business-building resources, including:

FPA Member Discounts

FPA members are connected to exclusive savings from the top practice management products and services. These discounted business resources include financial planning software, marketing consultations, education and certification programs and group insurance plans.

FPA Coaches Corner

This resource is your one-stop-shop for content and tools from the most recognized business coaches in the profession. Topics include marketing, business growth, compliance, cybersecurity, team development and the ‘financial planner’s mindset.’

FPA Research and Practice Institute™ (RPI)

RPI provides original research on business-centric topics and issues, including operations, personnel, human resources, marketing and technology. Detailed analysis, reports, whitepapers and resources based on the research will help you identify and address business gaps.

FPA Job Board

FPA members can explore career opportunities and search a large pool of applicants on FPA’s Job Board, a centralized source for financial planning employment. Job seekers showcase their skills and work experience, and search for jobs by career stage, location and more. Employers and recruiters have access to a highly qualified talent pool.

- Exclusive CFP® Professional Benefit -

FPA Plannersearch®

FPA PlannerSearch® is an online referral service where consumers can find a CFP® professional who best fits their needs. Planners utilize this tool to gain visibility among potential clients. Must be a current CFP® Professional Member to be eligible.

If you would like to learn more, contact us via email at

[email protected] or give us a call at (800) 322-4237, Option 2.

Nearly two-thirds of respondents stated that professional development is the most important benefit of membership, according to a recent FPA survey. Our signature events are one of the most powerful ways for members and non-members alike to take their practice and the profession overall to the next level.

FPA members receive attractive discounts for each of our signature events, including:

FPA Annual Conference

The FPA Annual Conference is the largest gathering of CFP® professionals and thought leaders in financial planning, delivering an amazing opportunity to pursue personal growth by connecting with your peers and learning from the top minds in the profession, and it allows you to lend your voice to the conversation, share your ideas and be an integral part of moving our community forward.

FPA Retreat

FPA Retreat is a genuinely unique experience fueled by the spirit of friendly discourse, a shared commitment to improvement and development and a structure without formal boundaries, creating an unmatched environment for learning, inspiration and making lifelong connections. A format focused on the powerful interactions and connections between planners who have come to view each other not just as peers, but as friends and confidantes, makes this event one you can’t afford to miss.

FPA NexGen Gathering

An annual event providing an opportunity to discuss hot topics and trends facing the future of the financial planning profession and a chance for financial planners to get to know peers, colleagues and the FPA leadership in an intimate and free-flowing setting. The event welcomes all members of the financial planning community to join the conversation and experience the pulse, passion and vision of the next generation of financial planners.

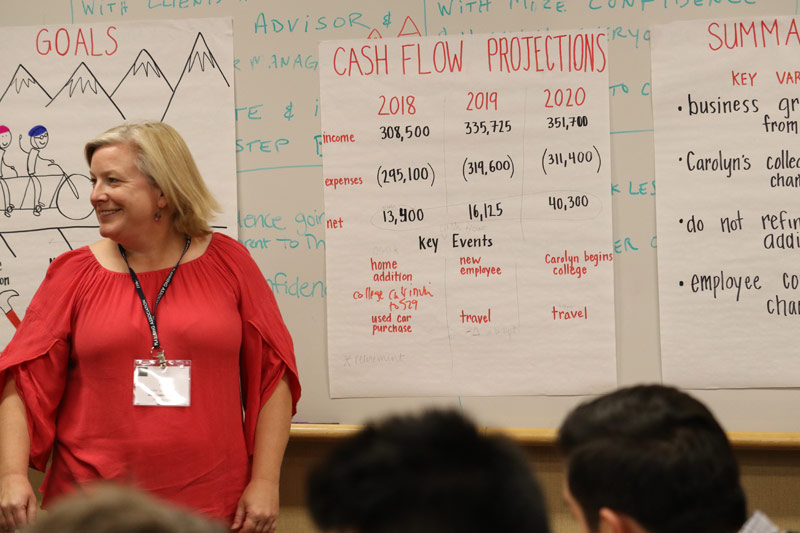

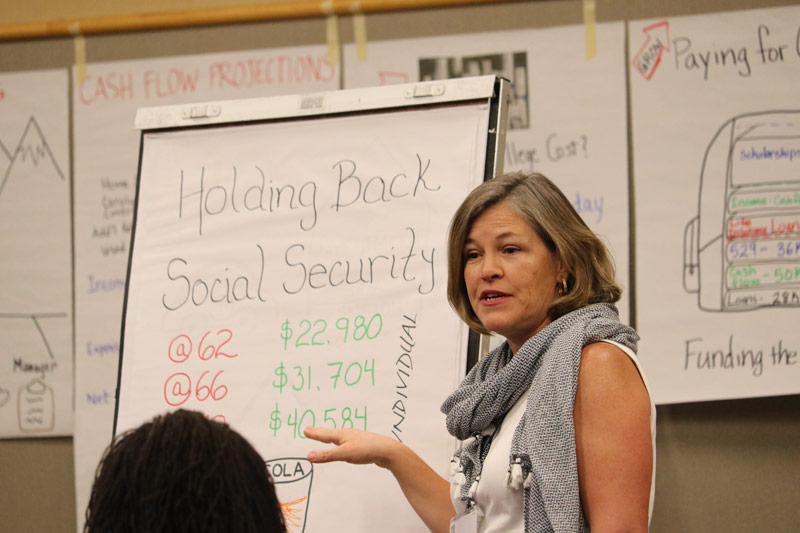

FPA Residency

Led by a faculty of highly-experienced and nationally-recognized deans and mentors, FPA Residency is a case study-based learning approach that develops the skills required to become a confident and competent professional. Class sizes are capped at 30 to allow for a more intimate and engaging learning experience.

FPA Advocacy Day

Join your fellow FPA members in Washington, D.C., to educate members of Congress about our profession, advocate for vital policy issues and protect the future of financial planning.

If you would like to learn more, contact us via email at

[email protected] or give us a call at (800) 322-4237, Option 2.